Climate Risk and Opportunity Management

In order to understand the risks and opportunities associated with climate change for MediaTek, the following description of management actions is based on the TCFD (Task Force on Climate-related Financial Disclosures) framework of governance, strategy, risk management, indicators and targets.

▌Climate Governance Framework

The Audit Committee serves as the Company's highest governing body for risk management and identifies "climate change risks" in accordance with our "Risk Management Policy and Procedures". This issue is subject to material identification and management by the ESG Committee based on the TCFD recommendations. The environmental task force regularly reports quarterly to the ESG Committee on the assessment and plans for climate risks and energy efficiency of the Company's operational sites, as well as various environmental impact assessments and target settings within the supply chain. Annually, it reports to the ESG Committee and the committee chairperson (Vice Chairman & CEO) on the current year's implementation plan and reviews past performance. Finally, discussion and execution results are reported annually to the Board of Directors.

▌Climate Change Risk and Opportunity Assessment

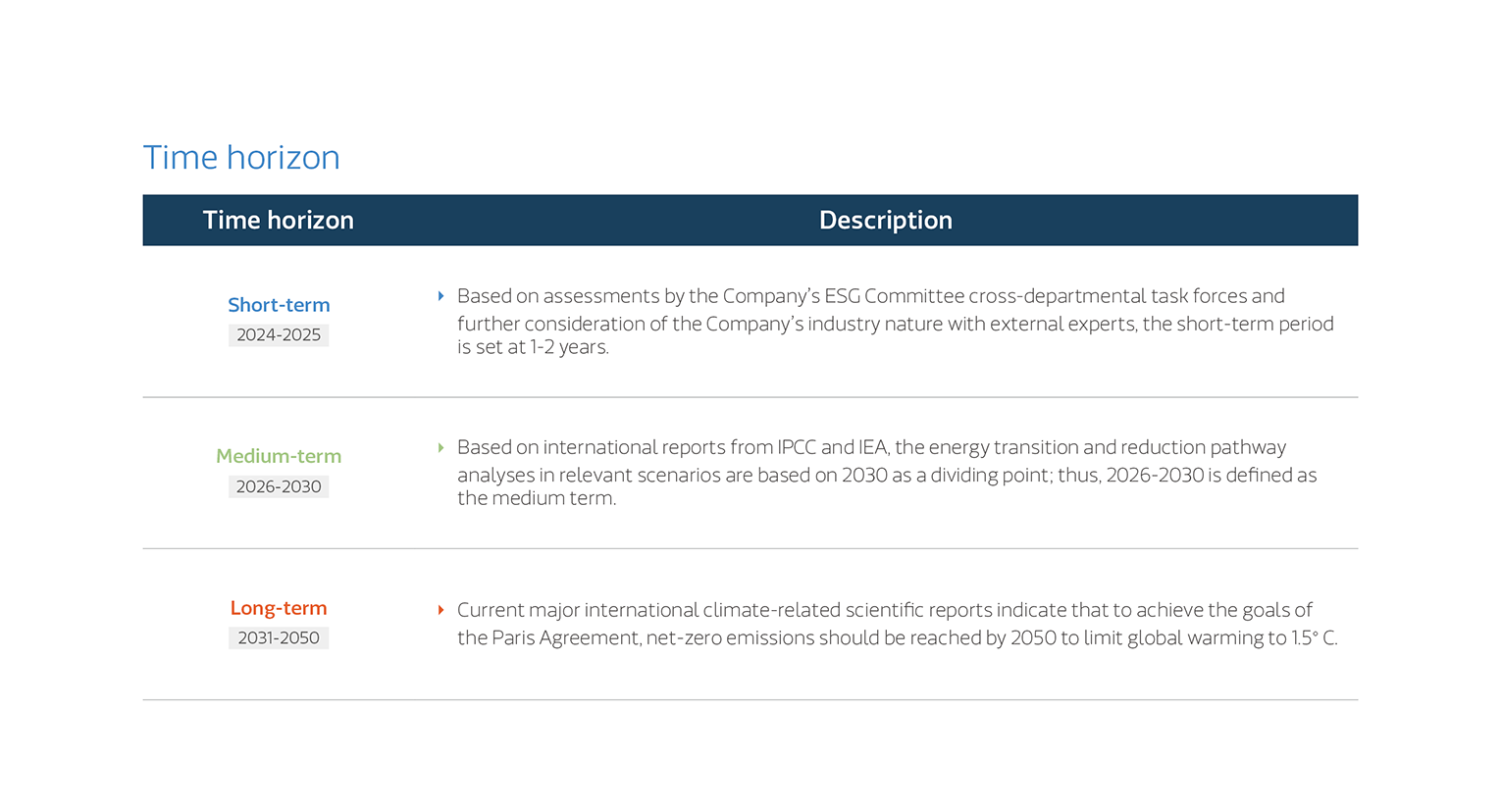

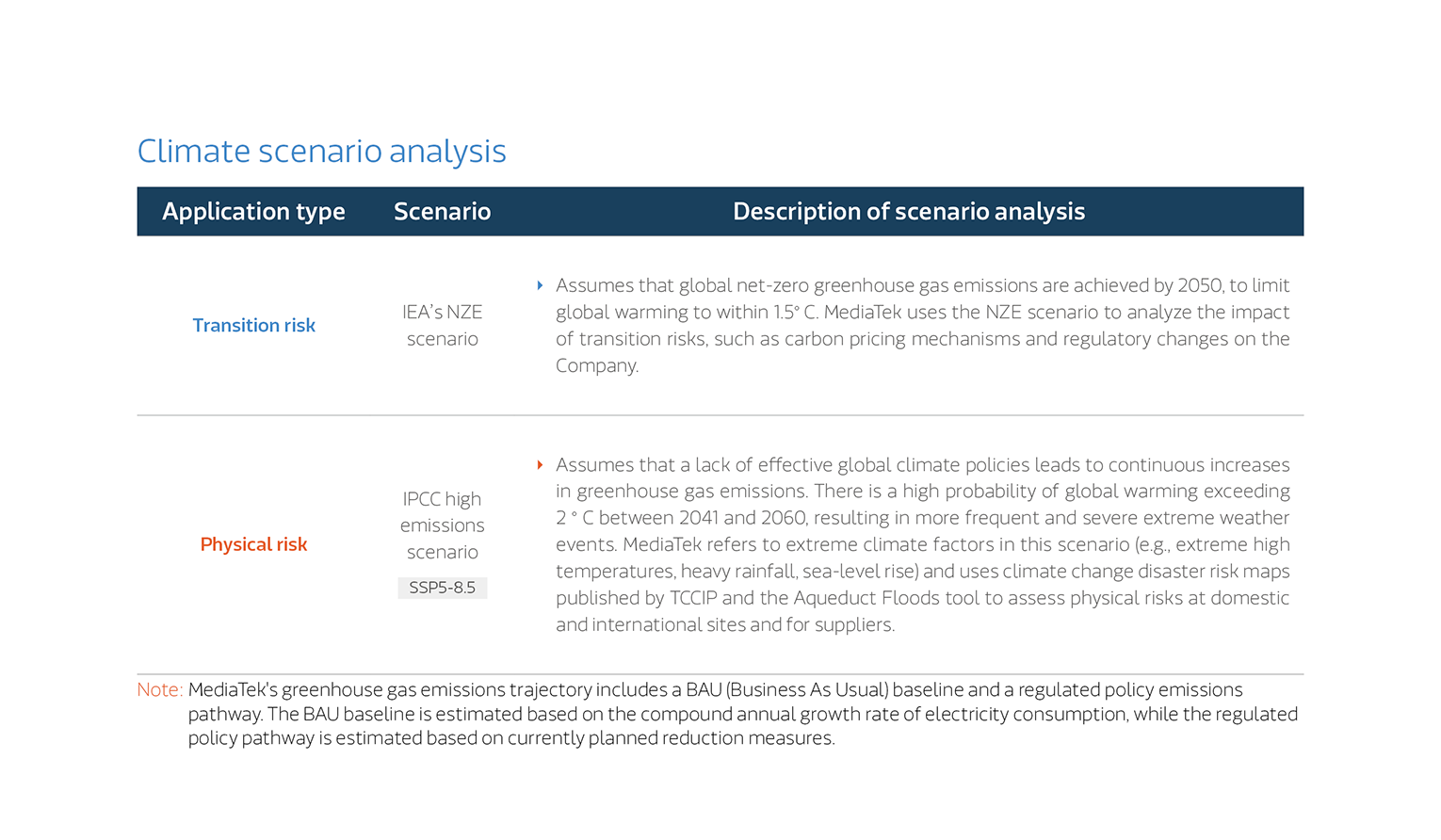

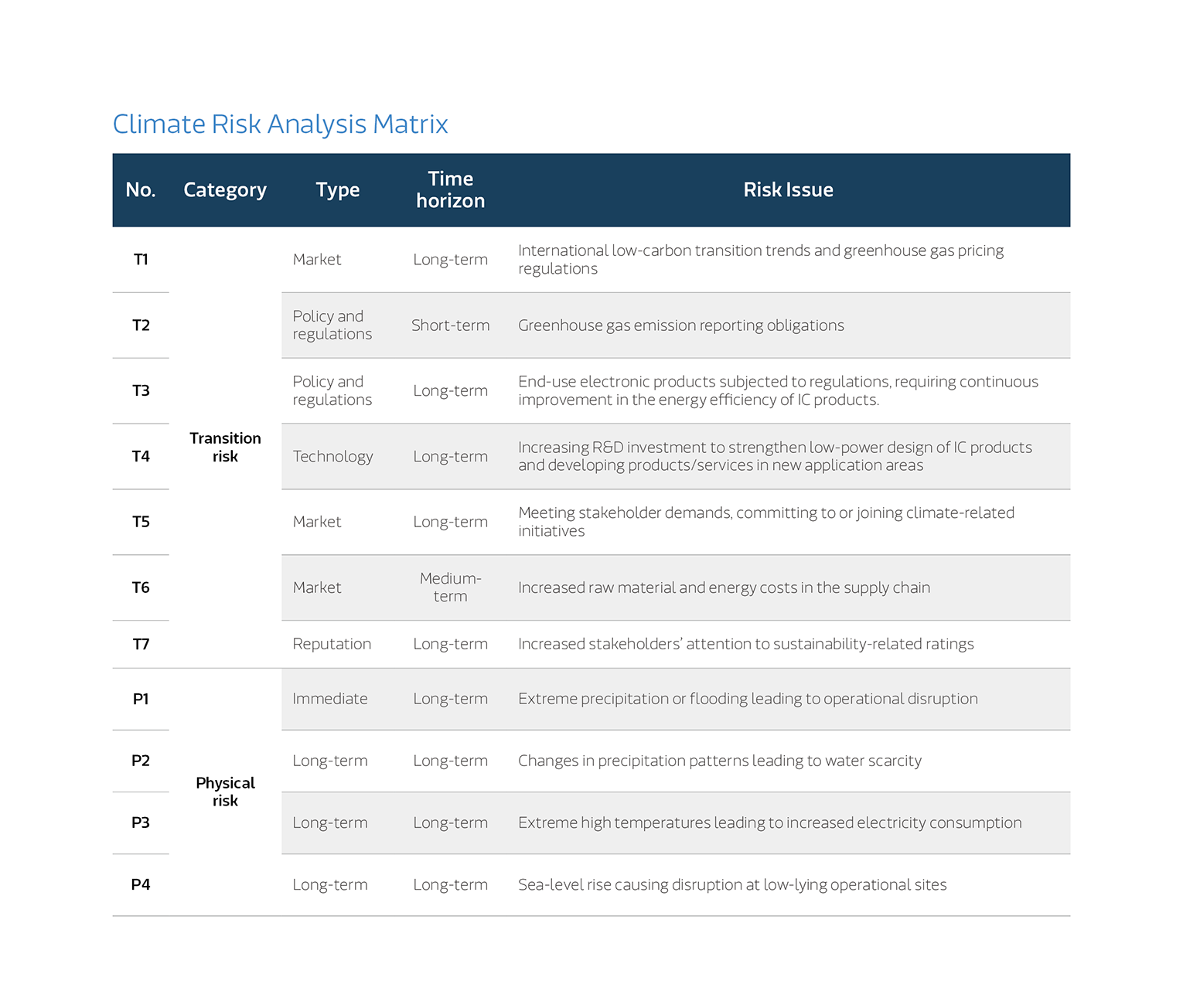

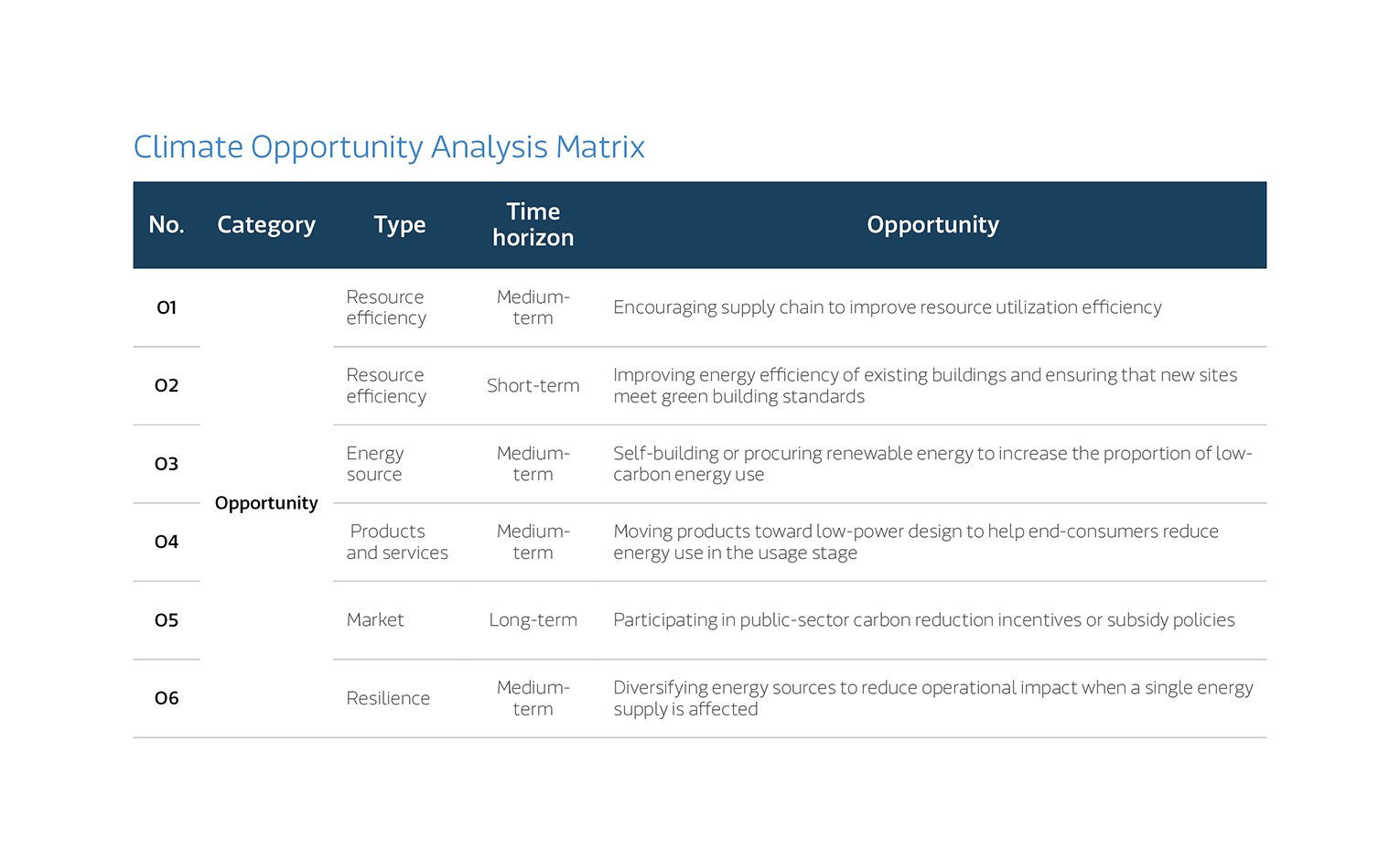

To comprehensively assess the potential risks and opportunities that climate change may bring to the Company's operations and strategy, we refer to the Net Zero Emissions (NZE) scenario published by the International Energy Agency (IEA), the most severe scenario (SSP5-8.5) proposed by the United Nations Intergovernmental Panel on Climate Change (IPCC), and compile climate risks and opportunities relevant to the semiconductor industry. Based on the TCFD framework, we identify climate issues most relevant to MediaTek and its supply chain, including transition risks (policy and regulations, market), physical risks (immediate), and opportunities (resource efficiency, and products and services). To further identify the impact of various climate issues on the Company across different time horizons, we define these as short-term (1-2 years): 2024-2025, medium-term (up to 2030), and long-term (up to 2050).

▌Materiality Assessment

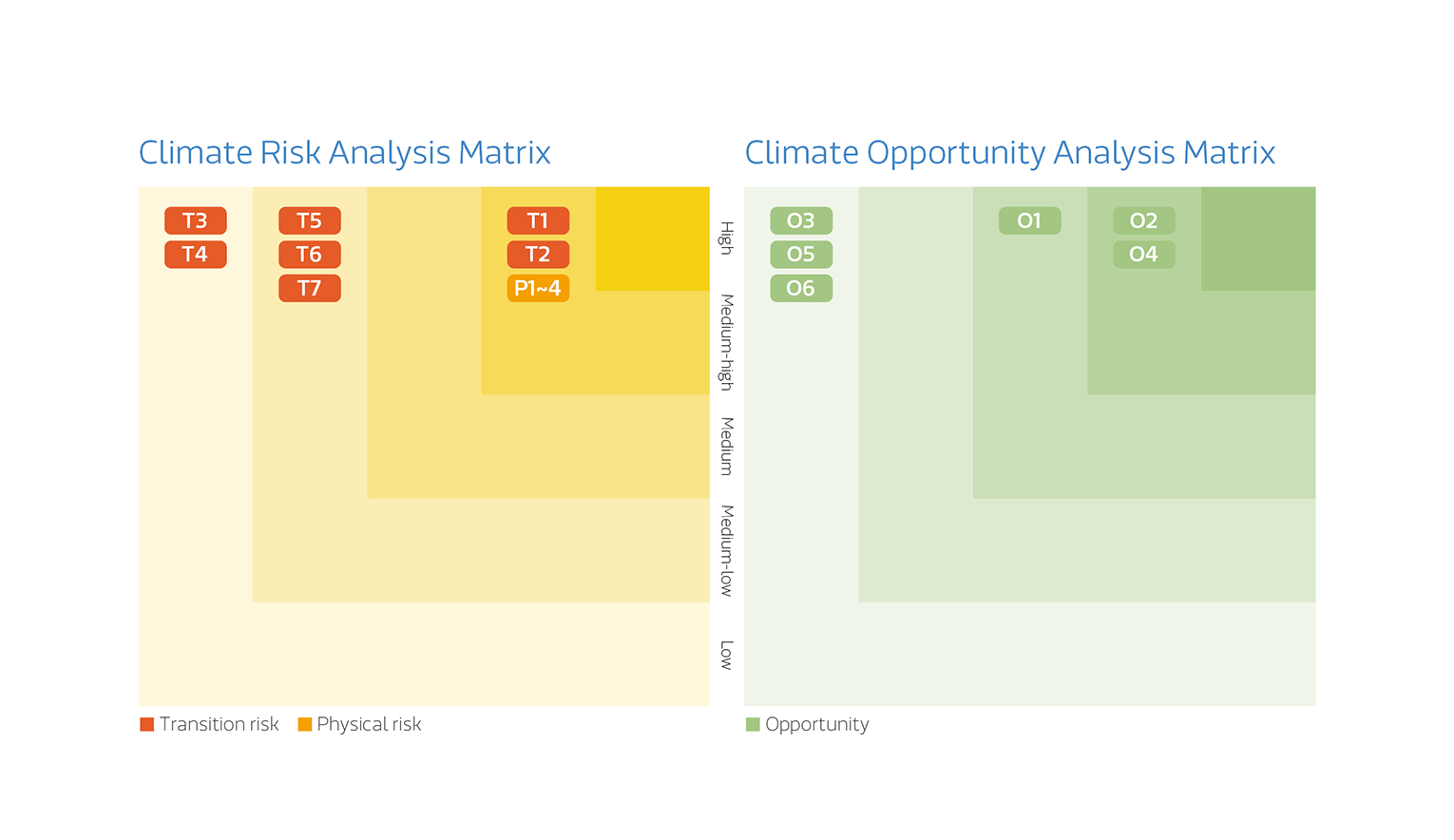

Referring to the ISO 31000 risk management framework, senior managers from relevant departments corresponding to climate risk and opportunity issues, along with external experts, further consider the Companys industry nature. They assess the time horizon, likelihood, and impact level of each issue based on their responsibilities and professional experience. This information is then compiled by the cross-departmental task force of the ESG Committee and ranked according to each departments evaluation results. The scores are categorized into five risk and opportunity levels from low to high, thereby establishing MediaTeks climate risk and opportunity matrix.

▌Material Climate Risk and Opportunity Management

● Climate Risk Management

MediaTek considers significant climate risks as major risks posed to operational activities and integrates them into the organizations existing risk management policy and procedures. Following the Companys risk management framework, which encompasses major risks facing operational processes, each operational unit is responsible for the actual execution of risk management plans. These plans include risk identification, risk analysis, risk assessment, risk response and control, and self-monitoring. Furthermore, the management of transition risks is implemented in supply chain sustainability management and the ISO 14001 Environmental Management System. We screen suppliers in the three major ESG dimensions. This involves verifying their established management systems and organizational structures, conducting annual on-site or document audits, arranging relevant education and training or improvement meetings, and holding supplier conferences to recognize and encourage outstanding suppliers. Consistency of environmental protection goals and implementation strategies is maintained by relying on the PDCA management cycle and through adoption of systematic management approaches. In addition, a pollution prevention and mitigation mechanism has been established to maximize MediaTeks influence in the field of environmental protection.

● Operational and Financial Impact Analysis

Based on the above results, the top three climate risks and opportunities are further analyzed for their potential impact on the Company and value chain, as detailed below:

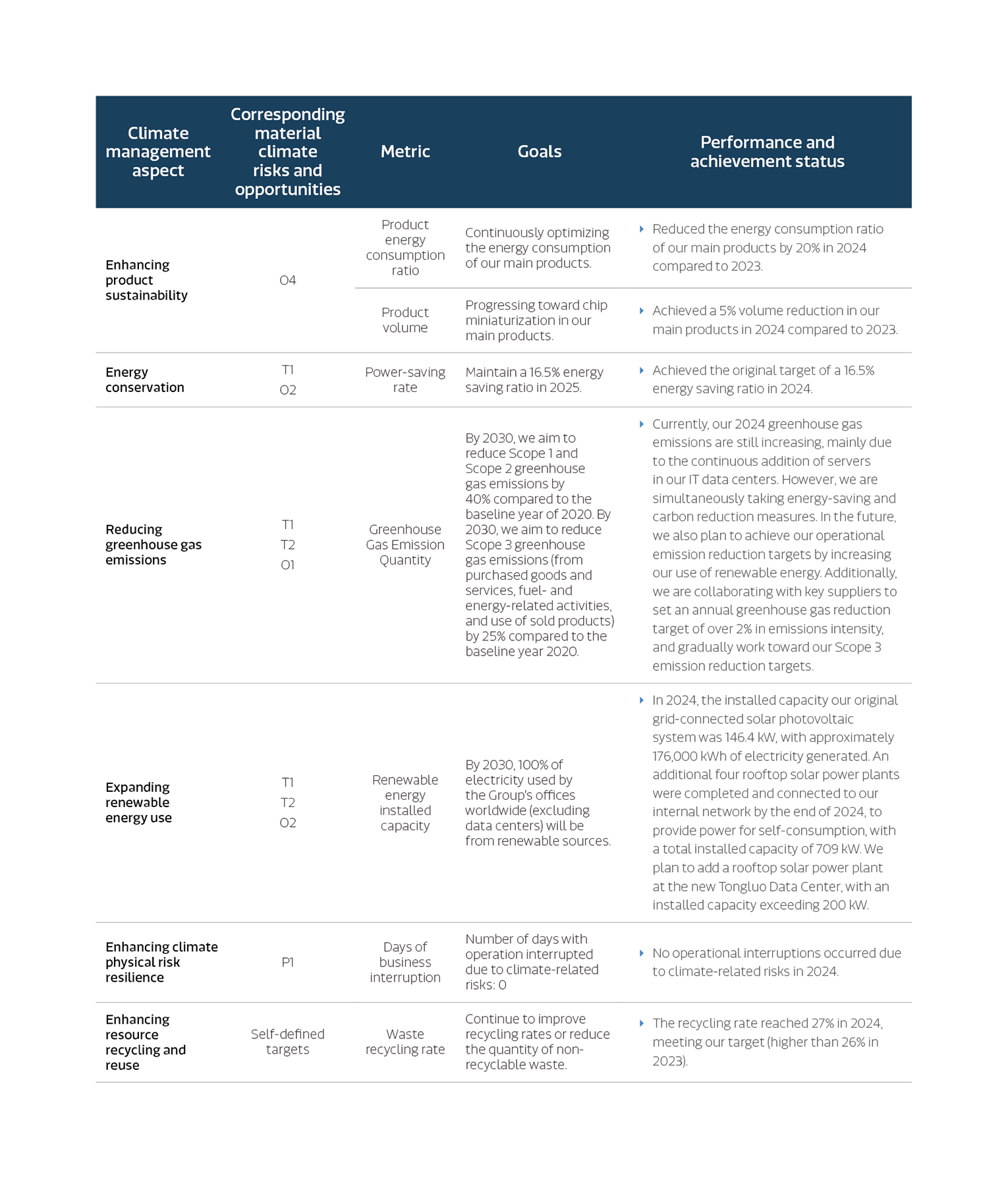

● Indicators and Targets

The Company has established climate-related metrics and targets, which are regularly reported to the ESG Committee for performance and achievement status tracking, as detailed in the table below. Simultaneously, to actively manage our sustainability goals, we have also incorporated them into the environmental criteria used when evaluating our managers remuneration.

▌Internal Carbon Pricing Implementation

To accelerate decarbonization, starting in 2025 we will implement an internal carbon pricing mechanism. In the initial phase, we will adopt a shadow price approach, set an internal carbon price range benchmarked to carbon pricing policies in our key operating locations, and apply it to major energy equipment procurement decisions.

For further details, see the “Environmental Management” section of the 2024 MediaTek ESG Report.